MAERSK’s acquisition of one of Asia’s leading logistics providers will allow the world’s biggest container line to integrate its logistics business with the entire supply chain of its 200 biggest customers, from production through to consumers’ doorsteps, retail stores and fulfilment warehouses.

The Danish company said it was buying Hong Kong-based LF Logistics in a deal worth $3.6bn.

The acquisition means Maersk can become a “large strategic part of our customers’ supply chain to support them even if there is no direct ocean element,” according to Vincent Clerc, head of the company’s Ocean & Logistics division.

“Getting capabilities in contract logistics across Asia, which is the fastest-growing market and today is one of the most strategic priorities from many of these top 200 customers, made a lot of sense because it suddenly put us in a place to further the relationship that we have with them and actually capitalise on growth in the rise of the East,” he said.

“We can leverage not only to capitalise on the rise of the East, but also we can take and export to other markets like South Asia, the Middle East’s Latin America or Europe.”

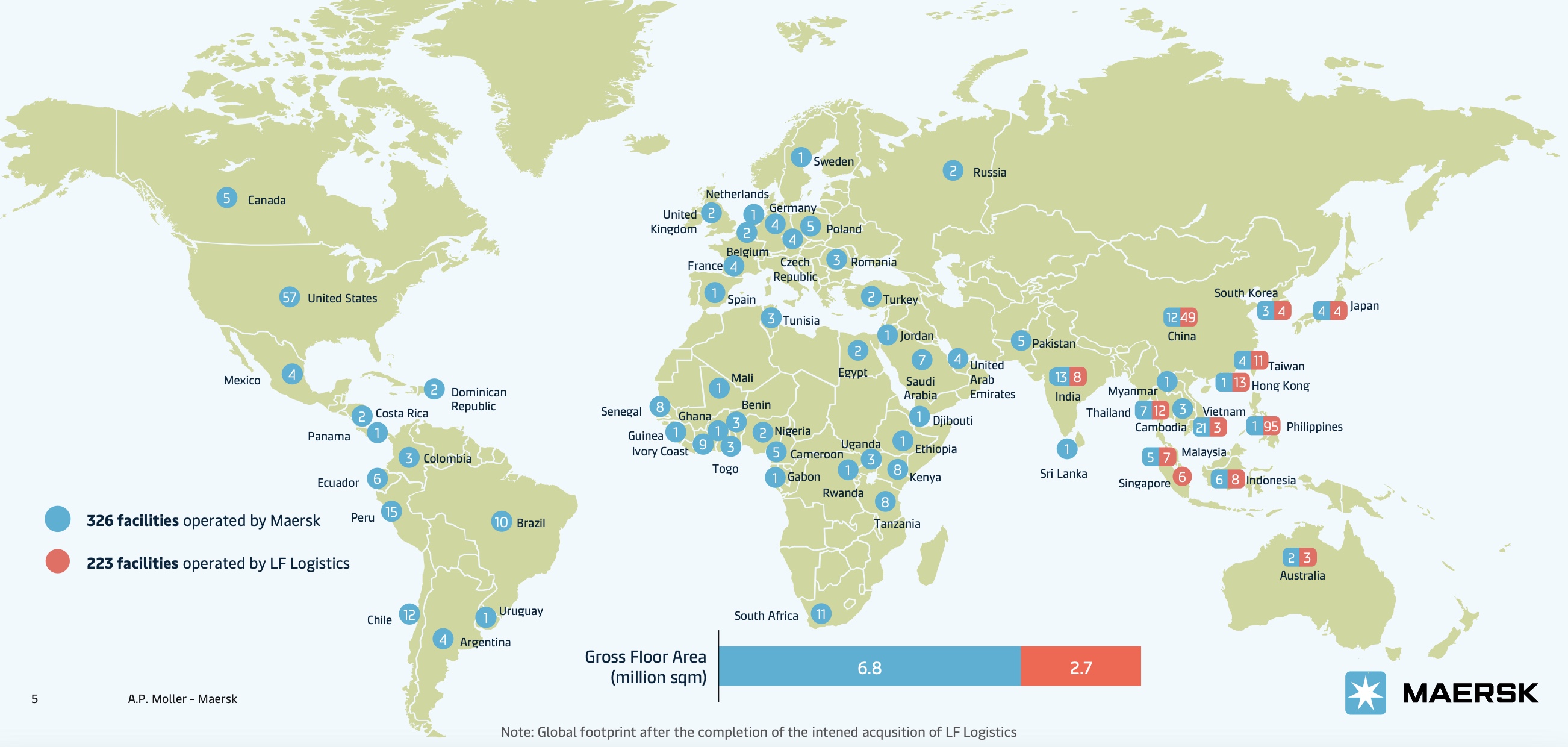

The deal to buy the in-country logistics division of LF Logistics will add 223 distribution centres across 15 countries in Asia.

Maersk already operates 326 freight and logistics facilities worldwide, with 57 in the US, as well as 89 across the Indian subcontinent and Asia, including 21 in Vietnam, 12 in China and 13 in India.

By contrast, 95 of LF Logistics’ centres are in the Philippines and 49 in China, according to a Maersk investor presentation.

The deal excludes the global freight management division, which covers freight-forwarding and provides about half of LF Logistics’ $2bn in revenue. Maersk closed its own Damco freight-forwarding brand at the end of 2020, integrating it within its logistics business.

How the container line, which already moves 20% of world box trade, will manage the freight-forwarding component for LF Logistics is unclear.

Maersk told a presentation it would enter a “strategic partnership” with Li & Fung, the parent company of LF Logistics “to develop logistics solutions” but did not provide further information.

Li & Fung “is expected to retain and continue to build out the carved-out global freight business following the completion of the transaction” it said.

The deal needs regulatory approval and is expected to close in 2022.

“I don’t think that it pits us against freight forwarders,” Mr Clerc told Lloyd’s List in an interview. “There are certain areas where we are competing with them today, where we have competed with them in the past and where we will compete with them in the future.

“There are other areas where they’re highly valued customers of ours, and yes, we have these dual relationships depending on different areas of the supply chain, but that has been there for a long time.”

Maersk expects LF Logistics revenue to double to $2bn by 2026, with integration costs of $80m over the next two years.

The purchase placed the container line as the world’s seventh-largest contracts logistics business, a presentation said, while immediately adding $1bn to the existing $9bn in revenues across its Logistics & Services division.

UPS, DHL Group, FedEx Corp, Kuehne + Nagel, Nippon Express and DB Schenker are the top six contract logistics businesses, based on revenues and warehouse space.

Maersk’s logistics revenues have grown 80% since the first quarter of 2020, which was related to volume growth not freight rates, Maersk chief executive Soren Skou told the investor call.

The intended purchase of “omnichannel” LF Logistics was “pandemic-agnostic” and had already been under consideration before the pandemic disrupted supply chains, according to Maersk. Omnichannel is a new marketing lexicon used to describe continuity of experience for customers across brands, formats and devices.

Mr Clerc said Maersk had not overpaid, even though the price implied that the company had doubled in value based on what Singapore’s Temasek paid for a 22% stake in LF Logistics in 2019.

“There’s been a few things that have changed since Temasek came in,” he said. “The group was going through a lot of restructuring and a lot of changes, and certainly they got a very good deal to come in at that point.

“Second, the business has grown significantly, it has grown every year, but it has grown significantly more than 20% to 25% since they came in and valuations have come up also during the pandemic.

“Plus, we are paying a control premium because we are taking over the entirety of the business whereas Temasek was just taking a minority share.”